Disconnected from reality?

Are elevated prices in U.S. markets showing a disconnect from reality? Is the free flowing Federal Reserve liquidity too easily available? Are central banks too eager to please? Are central bank fearful of failure? Do they really need to step in every time economies face a problem?

Should markets work it out without so much central bank intervention or interference? Do we now have too much debt, again and… have we built a new bubble – the mother of all bubbles?

Bubble busters

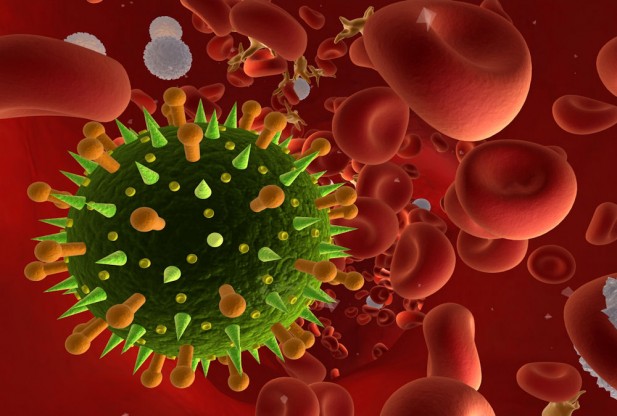

Take the COVID-19 coronavirus outbreak for instance. Initially, markets dropped only to recover all the losses to set new all time highs! And this despite the virus outbreak growing significantly in the background. Is this a normal market reaction? Shouldn’t investors behave more carefully with such a potential problem as this?

Are investors underestimating the impact the virus outbreak could have on the Chinese economy? What about the potential knock-on impact of global economies?

This isn’t the only event that the markets have shrugged off recently. Markets, especially in the U.S., have gone up against a back drop of many uncertainties. They have shrugged of the China – U.S. trade war, tariffs, a presidential impeachment, increased world debt, military killings and Iranian missile attacks on U.S. bases, oil refinery attacks in Saudi Arabia, and now the markets are happy to ignore a deadly virus outbreak.

Don’t ignore the obvious

Can markets really afford to ignore the COVID-19 coronavirus outbreak in China? It’s all very well shrugging off these events – but ignore them at your peril.

The COVID-19 coronavirus may not be the catalyst to set off the long over due market correction. But there will be a correction, and soon.

The bubble will burst – let’s hope we don’t ‘blow it up’ too big!