Investors have something else to fret about right now as they worry that U.S. – Iran tensions may escalate.

Iran has threatened retaliation in response to the U.S air strike that killed an Iranian military commander in Iraq last week.

Oil

Oil prices increased initially after the attack, but have since stabilised from their initial spike.

Equities moved down initially but have since recovered some of their losses. They have yet to regain the high reached on the first trading day of 2020.

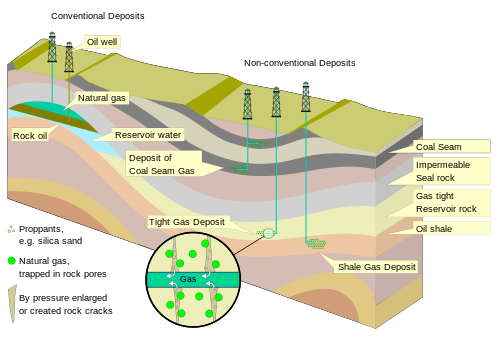

U.S. shale production

The international oil and gas production landscape has changed dramatically with the U.S. now a major global producer and exporter.

U.S. shale gas exploration and production has increased dramatically during the last 5-10 years and this has helped reduce the oil price volatility usually experienced during such a crisis as this.

I feel that if the U.S. wasn’t such a big world player in gas and oil production – the oil price would have increased by much much more.

History tell us…

History, as shown through many previous world events, that unexpected terrorist and military conflicts typically initially cause a sharp market response – this is then usually followed by a consolidation period, and then by recovery.

Often over time, markets tend to recover unless the first shock brings a global recession with it…?

U.S. markets

U.S. stocks have held up well. The Dow closed above 28700 Monday 6th January 2020 and the S&P 500 and Nasdaq held on to Monday’s gains too. The FTSE 100 closed at 7575.

It would appear that even the threat of a Middle East conflict can’t throw U.S. equities off course… at least not yet?

It’s worth noting that gold has gained in value as some investors seek a safe haven.

Is Iran now the new trade war?