U.S. – China trade talks to resume October. Market moving daily news roundup – events & news likely to move markets 5th September 2019

Company performance, economic and political events but especially market sentiment will always influence market movement, good or bad.

Summary

Economic calendar – scheduled news and events 5th September 2019

Australia – trade balance data due

Switzerland – GDP data due

Germany – factory orders data due: 07:00 BST

EU – ECB member speech due: 08:00 BST

U.S. – jobless employment data & non-farm productivity due: 13:30 BST

U.S. – service and manufacturing PMI data due from: 14:45 BST

UK – BoE member speech due: 15:30 BST

U.S. – bill auction (4 week) due: 16:30 BST

Asian markets climb Thursday

Asian markets climb Thursday as reports surface suggesting U.S – China trade talks likely to resume in earnest in October. U.S. stock futures climb also – the Dow up around 200 points on this news. Japan’s Nikkei index was up some 2.4% to close at: 21086.

Boris bashed again

Boris Johnson’s Brexit plans get bashed yet again as his call for a ‘snap’ general election are firmly rejected by the commons. That is now three defeats in two days, and parliament have only been back two days after the summer recess.

House of Lords look set to pass the Brexit ‘no-deal’ bill – this may force the Labour leader to commit to a general election. How many cards does Boris have left to play? Where now for Boris? How likely is a general election now?

Other market moving news

Brexit is placing manufacturers under severe pressure, a study released Thursday by Make UK suggests.

UK company updates

Dixons Carphone has issued a quarterly trading update – see here, mobile phone sector is ‘challenging’. Online retailer Boohoo says its trading in the first half was, ‘ahead of expectations…’ Transport firm Go-Ahead Group reported lower annual pre-tax profit as earnings at its rail division fall.

As Boris is bashed by Brexit, Sterling has been buoyed. The Pound has recovered to $1.23 (as at: 11:00 BST 5th September 2019). FTSE 100 at: 7266 down 48 points (11:00 BST).

U.S. – China trade talks confirmed

China and the US will hold high level trade talks in Washington in the coming weeks.

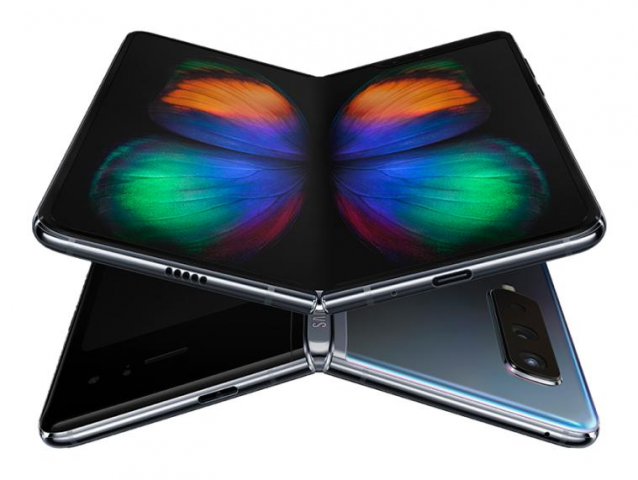

Foldable ‘phone release from Samsung

Samsung’s first foldable ‘phone will go on sale on 6th September 2019. The Galaxy Fold will be available in South Korea, then the U.S., the UK and Singapore.

Its initial release was delayed because of problems with the folding screen.

Bank shares fall on PPI concerns.

It is claimed that the industry PPI bill could be pushed up to as high as £53 billion. Co-op bank, Virgin Money, CYBG – owner of Clydesale, and Yorkshire shares fall. Could this lead to wider repercussions for other banks?

Dow jumps

Dow jumps at the open – up around 300 points as trade talks between U.S. and China reportedly set to resume in October. Better than expected jobs data is helping too as U.S. private sector added more jobs than projected.

Dow continues to climb up over 400 points at 15:45 BST 5th September 2019. Tech stocks making biggest gains.

Yahoo suffers system failures today but most service now back up an running Yahoo says.

Slack disappoints – shares fall. See here for Slack investor information.

Sterling climbs higher in afternoon trade as fears of a ‘no-deal’ Brexit subside a little. FTSE 100 falls as pound climbs.

Jo Johnson (Boris Johnson’s brother) resigns – in another blow for the PM.

U.S. indices all close up after positive news that the U.S. & China will be restart talks in October. Some pundits believe there will be more substance to these talks and that a deal will be more likely this time round. Dow closed up at: 26728 gaining some 372 points on the day.

Stock market indices update, 5th September 2019

Closing positions of: FTSE 100, DAX, DOW, S&P 500, NASDAQ, NIKKEI & GOLD

FTSE 100 – closed at: 7271

DAX – closed at: 12127

DOW – closed at: 26728

S&P 500 – closed at: 2976

NASDAQ – closed at: 8116

NIKKEI – closed at: 21086

GOLD – closed at around: $1,527

Key: Green highlight markets move up. Red highlight markets move down. All values rounded.

Note

Company performance, economic and political events but especially market ‘sentiment’ will always influence market movement, for the good or bad.