In June the price of gold hit a six year high and trickled above $1,400

Amid growing fears of an interest rate cut leaving savers with even lower returns and with concerns that the stock market is slowing, more and more investors are turning to gold as a safe haven.

Economic uncertainty

Gold has always been a favourite for investors to retreat to in times of uncertainty. And, at the moment we have plenty of that!

From concerns of interest rate cuts, trade wars and tariff tantrums to failed investment funds and talk of global economic slowdown. Investors are choosing to place some of their assets in gold, perceived as a safe haven.

For instance, Sterling is currently trading at close to a six month low and some investors are offloading currency and moving to gold and other assets.

Don’t be too dazzled by the recent price of gold though. Like any investment… little, often and long term saving should be the norm. Don’t be tempted to rush and invest in gold too quickly or too heavily. Always take a balanced view.

Gold price

The price of gold peaked during the financial crisis at around $1,900 an ounce in 2011, falling to $1,050 in 2015. Today (8th July 2019), gold is trading at slightly under $1,400 per ounce.

How and where to buy gold

Gold can be purchased directly from the Royal Mint or from bullion brokers such as: Sharps Pixely, Baird & Co. or from Bullion by Post. It’s also possible to trade with your broker and online broker too. Gold can also be traded on spread trading platforms. Economoney does not advocate any of these trading methods. We do not recommend any and we do not receive commission from these sites. It’s your choice, so as always, please make sure you do your proper research!

You may also trade with your stock broker, bank, or even via a tracker fund. Always take advice before trading! ALWAYS!

Tax free

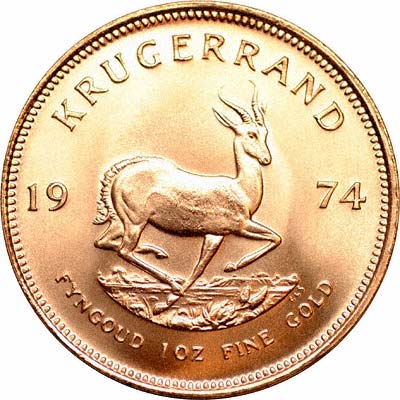

Another very popular way of owning gold is through buying coins. Buying gold coins will enable you to buy in smaller denominations. Unlike other forms of gold, coins are free from capital gains tax. When you sell your coins for a profit it will be tax free! What’s not to like about coins?

Popular gold coins

Popular gold coin choices are the sovereign or half sovereign. The krugerrand is also a very popular choice. The Krugerrand is one of the most popular one-ounce bullion gold coins in the world. See here for details at The Royal Mint Bullion. Other well known online

You may also wish to consider setting up an online account at Royal Mint, for instance to make your purchase. This will allow you to buy small amounts of gold on a regular basis. You do not actually own the physical gold but you will own a percentage fraction of the gold held by The Royal Mint.

Remember though, as in any investment always do your research! And then… check again!

We do not recommend or advise or make any suggestions on how you should trade gold, if at all. It’s all your choice. It’s down to you.

Good luck!

Golds holds at around $1,400 (8th July 2019)